Help build a better insurance

Make insurance more accessible and convenient to everyone

Everything Insurance

A simple idea to help build a better insurance

Founded in October 2017 and headquartered in Nairobi, Kakbima is the brainchild of passionate people with a mission to re-imagine and help build a better insurance. We set out to provide tools that help industry players provide the kind of insurance experience that fits the way we all live and operate today; make insurance instant, honest and delightful anywhere, anytime for everyone.

Kakbima was founded on the principle that technology should drive the insurance transaction and insurance should be bought, not sold. That is why we have brought numerous insurance purchase and management processes into the digital space.

Meet Kakbima

We’re an insurtech that provides tools to connect insurers, distribution partners, and customers to transform the way insurance is bought, managed and sold. At the center of the ecosystem is our insurance management and distribution platform that removes the barriers to flexible products development and distribution channels helping more new businesses get started, expedite growth for existing companies, and increases global consumer coverage.

We have broken down insurance functions into individual business services allowing ease of maintenance and independent deployment of features. Insurance distributors can easily put up their products which will be accessible to every individual who interacts with our platform or integration partners looking for insurance.

The platform’s features combine Customer Relationship Management (CRM), products (Motor and Motorcycle fully supported), policy, claims management, quotations automation, premium payments, and much more in a single, integrated platform, enabling our users focus on what matters.

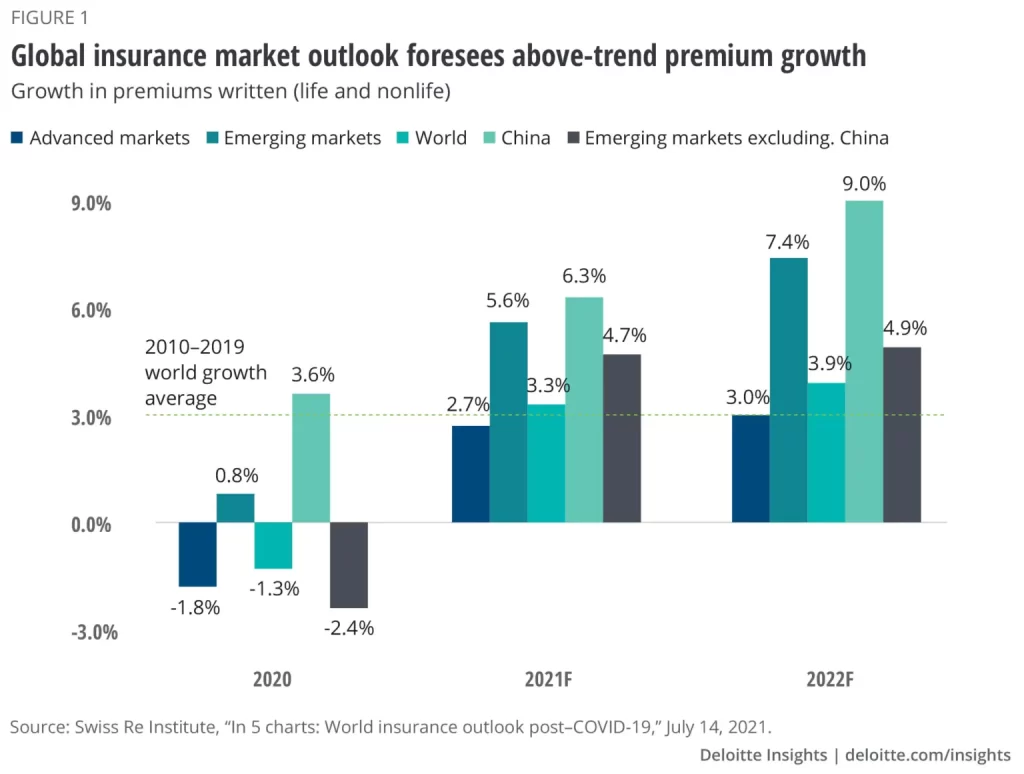

The potential of the insurance industry

Over the past decade, overall global insurance penetration; defined as insurance premiums/GDP, has remained relatively low. With in life penetration declining while in non-life insurance penetration has increasing sparked by medical insurances’ growth.

Despite this, global insurance penetration is about 3.35% for the life segment and 3.88% for the non-life segment.

Regulatory complexity, a byzantine global insurance system, and a shortage of diverse insurance products with better distribution channels are constraining the growth of insurance.

Removing the barriers to flexible products development and distribution channels helps more new businesses get started, expedites growth for existing companies, and increases global consumer coverage.

Committed to significantly help build a better insurance

Advancing insurance technology

We unify our practices, partnerships, and products around a single vision — make insurance instant, honest and delightful.

Respecting and protecting our users

Keeping our users safe online with industry-defining tools, features, and principles.

Including all voices

Building a world where progress, equitable outcomes, diversity, and inclusion can be realities both inside and outside our workplace.

Expanding opportunity

Investing in communities, individuals, and local economies by preparing them for the opportunities of today — and tomorrow.

Impactful core values

Our community is bigger than just us

We foster the global producer and policyholder communities because they are the source of our ideas and innovation, essential to our sustained growth.

Earn trust, loyalty and respect every day

Earning trust every day is our core value proposition to our customers and to each other. We must be trustworthy, because the opportunity to serve our customers is larger than any one of us.

Technology innovation and simplicity

We are a team of engineers and designers, and we hold the products we craft to the highest standard. We believe in pushing the envelope in moving insurance away from it’s archaic technology in the simplest way possible.

Get answers for all your questions on how you can use our brand elements

Whether you’re a insurance buyer, agent, broker, micro-insurer, insurer, filmmaker or software developer we’ll help you learn when and how you can use our logo, product icons, and other brand elements in your work.

Making insurance better with a little help from our products

Some description of products to be here

Files Folder Storage

A better way to secure access to all your files. Collaborate with insurers, microinsurers, brokers, and agents from any device.

Kakbima Assistant

Use natural language helps users buy insurance, book appointments, find agents near me, and more.

Kakbima Auto

A combination of telecommunications with vehicular technology that enables insurance companies monitor various elements of a driver’s behaviour

Some description of products to be here

Kakbima My Business

Update your free Business Profile on Google with contact info, open hours, photos, and more

Bimabot

A chatbot that uses natural-language text-based conversation to help current and potential policyholders find an insurance cover.

Insurance Consumer Awareness

Insurance explained. Providing some of the basic terms within insurance to users.

Kakbima Auto

A combination of telecommunications with vehicular technology that enables insurance companies monitor various elements of a driver’s behaviour

Join our team to help build a better insurance

Some call it a job. We call it a dream! Live and work from anywhere in the world. Focus on doing great work!